Different payment methods of My DSO Manager

Credit managers strategically leverage digital payment portals or platforms during collection efforts to prompt clients to settle outstanding invoices. These platforms offer notable benefits, including convenience, efficiency, and security.

Digital payment portals provide clients with the flexibility to settle invoices at their convenience. They streamline payment processing, reducing time and effort for both clients and businesses, resulting in improved cash flow and liquidity.

Security is paramount in digital transactions, and payment portals typically implement robust measures to safeguard financial data. This assurance instills confidence in clients, enhancing their peace of mind during transactions.

The decision to offer various payment options depends on factors like client preferences, business nature, and payment system capabilities. Diversifying payment methods caters to different client needs, potentially boosting timely payments.

While board management typically determines the payment options, credit managers play a pivotal role in advising based on client needs and industry standards. They may also negotiate payment terms with clients, ensuring efficient processing.

In today's digital era, offering diverse payment methods is crucial for effective credit management. Understanding client preferences is essential, as each client may favor different methods. Providing a range of options enhances customer satisfaction and strengthens business relationships.

However, with diverse payment methods come varying risks. Traditional methods may pose processing delays, while digital solutions introduce cyber fraud risks. Implementing robust risk management strategies is essential to protecting business interests.

Flexibility is key in payment methods, allowing clients to choose options that suit their financial circumstances. Features such as recurring billing or secure payment information storage streamline processes and bolster trust.

Cost-consciousness is vital, considering transaction fees and charges associated with each payment method. Evaluating cost-effectiveness and negotiating favorable terms with providers are essential steps.

Compliance with regulations is non-negotiable, ensuring adherence to data protection laws and standards. Non-compliance can result in severe penalties and reputational damage.

Integration with existing systems and scalability are critical for operational efficiency. Leveraging technology and automation streamlines processes, reduces errors, and accommodates business growth.

In our constellation, we recognize the importance of streamlining payment processes for credit managers. That's why we offer a comprehensive suite of digital payment options, including Payzen, Stripe, SSP, Paytweak, Chargebee, Payplug, PayPal, Ingenico, BlueSnap, and more.

- Payzen: Payzen is a payment gateway solution provided by Lyra Network. It offers online payment processing services for businesses, enabling them to accept various payment methods securely over the internet.

- Stripe: Stripe is a popular payment processing platform that allows businesses to accept payments online. It provides a simple and developer-friendly API for integrating payment processing into websites and mobile applications.

- SSP (Simple subscription Platform): SSP is a subscription management platform that helps businesses manage recurring billing, subscriptions, and invoicing. It simplifies the process of setting up and managing subscription-based services.

- Paytweak: Paytweak is a payment solution that enables businesses to accept payments online through various payment methods. It offers features such as online invoicing, payment links, and secure payment processing.

- Chargebee: Chargebee is a subscription management and recurring billing platform designed for subscription-based businesses. It helps businesses automate subscription billing, invoicing, and revenue management processes.

- Payplug: Payplug is a payment processing solution that allows businesses to accept payments online. It provides features such as secure payment processing, customizable payment pages, and integration with e-commerce platforms.

- Paypal: PayPal is one of the most widely used online payment platforms globally. It allows individuals and businesses to send and receive payments securely over the internet. PayPal supports various payment methods, including credit/debit cards and bank transfers.

- Ingenico: Ingenico is a leading provider of payment solutions, including point-of-sale terminals, payment gateways, and online payment processing services. It offers secure and reliable payment solutions for businesses of all sizes.

- BlueSnap: BlueSnap is a global payment processing platform that helps businesses accept payments online. It offers features such as multi-currency support, recurring billing, and fraud prevention tools.

Each of these payment options has its own set of features, pricing plans, and integration options.

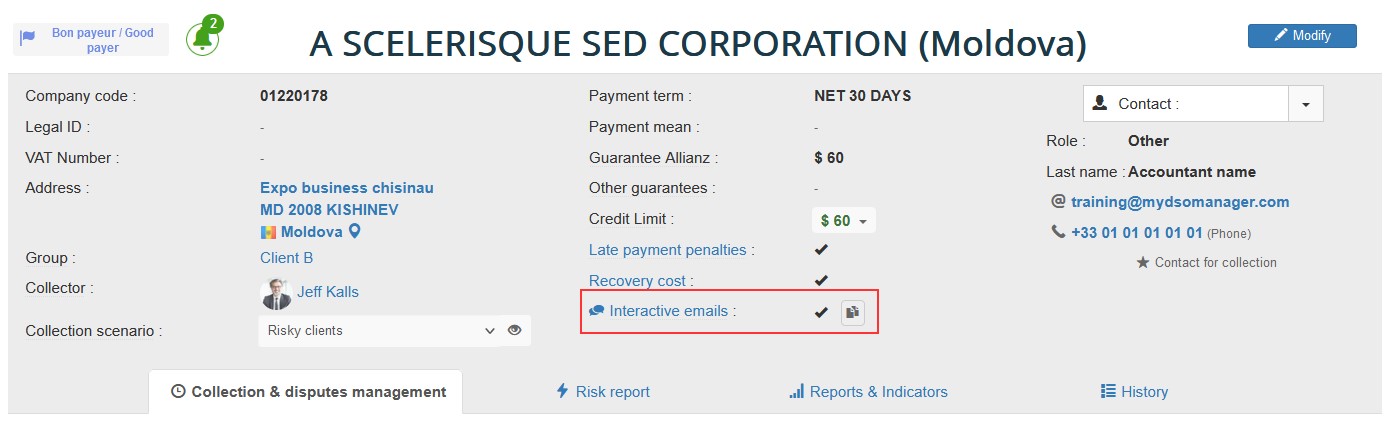

Consolidating various payment methods into a single platform is one aspect of My DSO Manager's service, but it isn't the core focus of our functionality. At the heart of our system lies a feature that facilitates payment accessibility for clients: Interactive pages/emails. An area that is accessible through the customer file and serves as a communication hub between you and your clients.

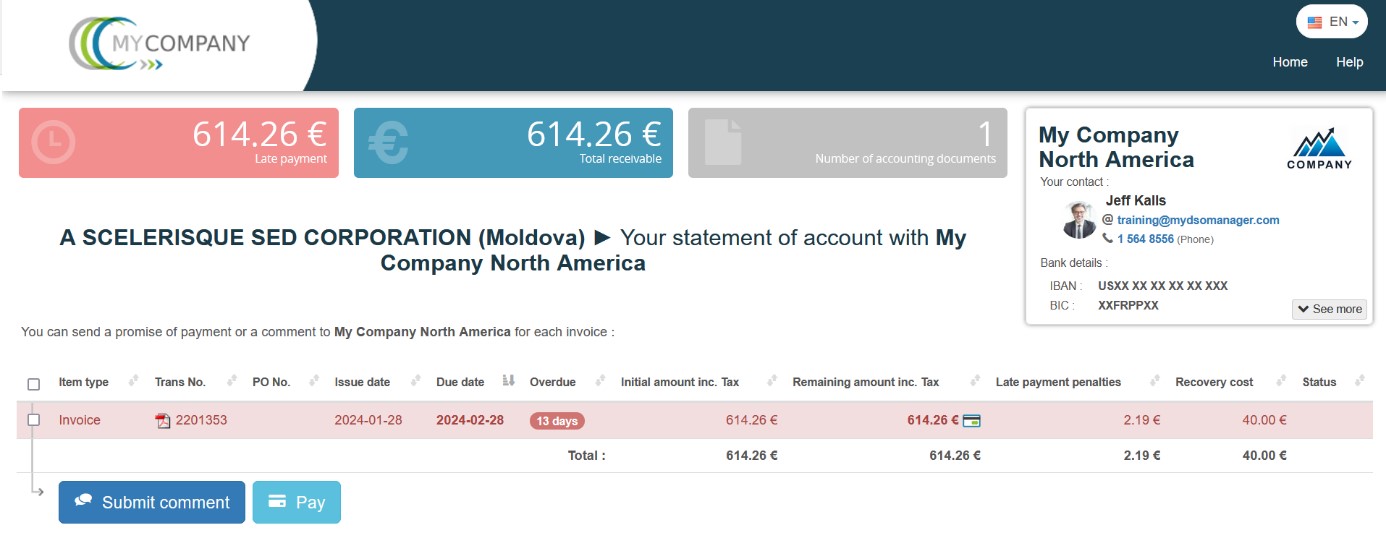

Within this interface, clients can easily find essential account receivable information and proceed with payments through an integrated payment button.

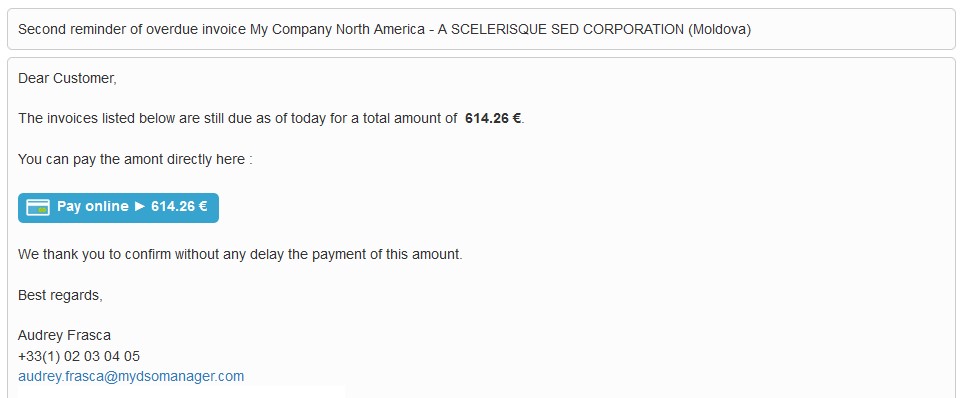

This payment button isn't limited to Interactive Pages; it can also be seamlessly incorporated into dunning emails or any other communication channels with the client (even chats).

By centralizing these options and functionalities in one user-friendly interface, we aim to simplify the lives of credit managers, allowing them to efficiently manage collections and optimize cash flow. These tailored solutions address specific client needs, streamlining payment processes and ultimately contributing to business success.