Combine the ergonomics of My DSO Manager with the most relevant corporate reports

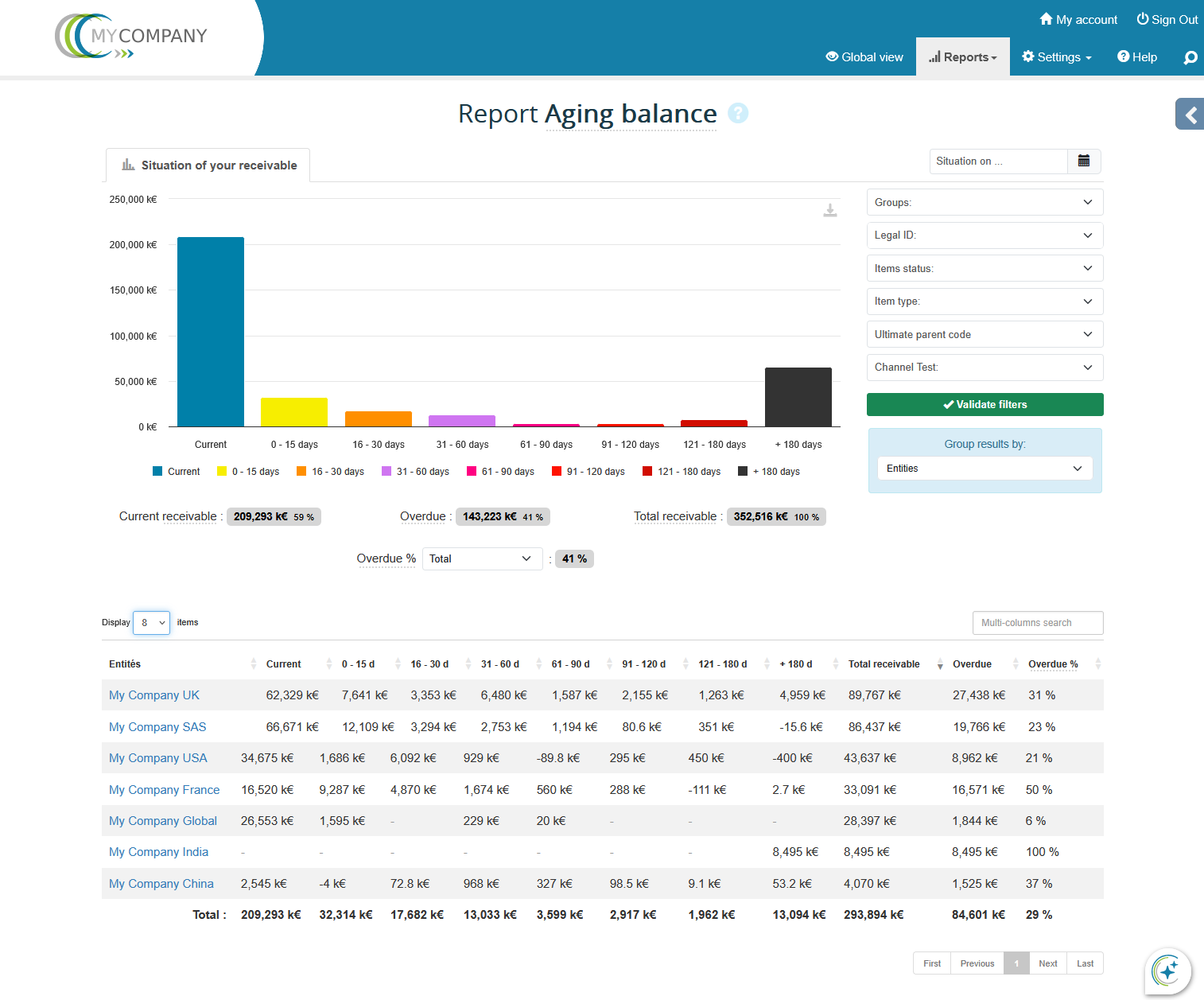

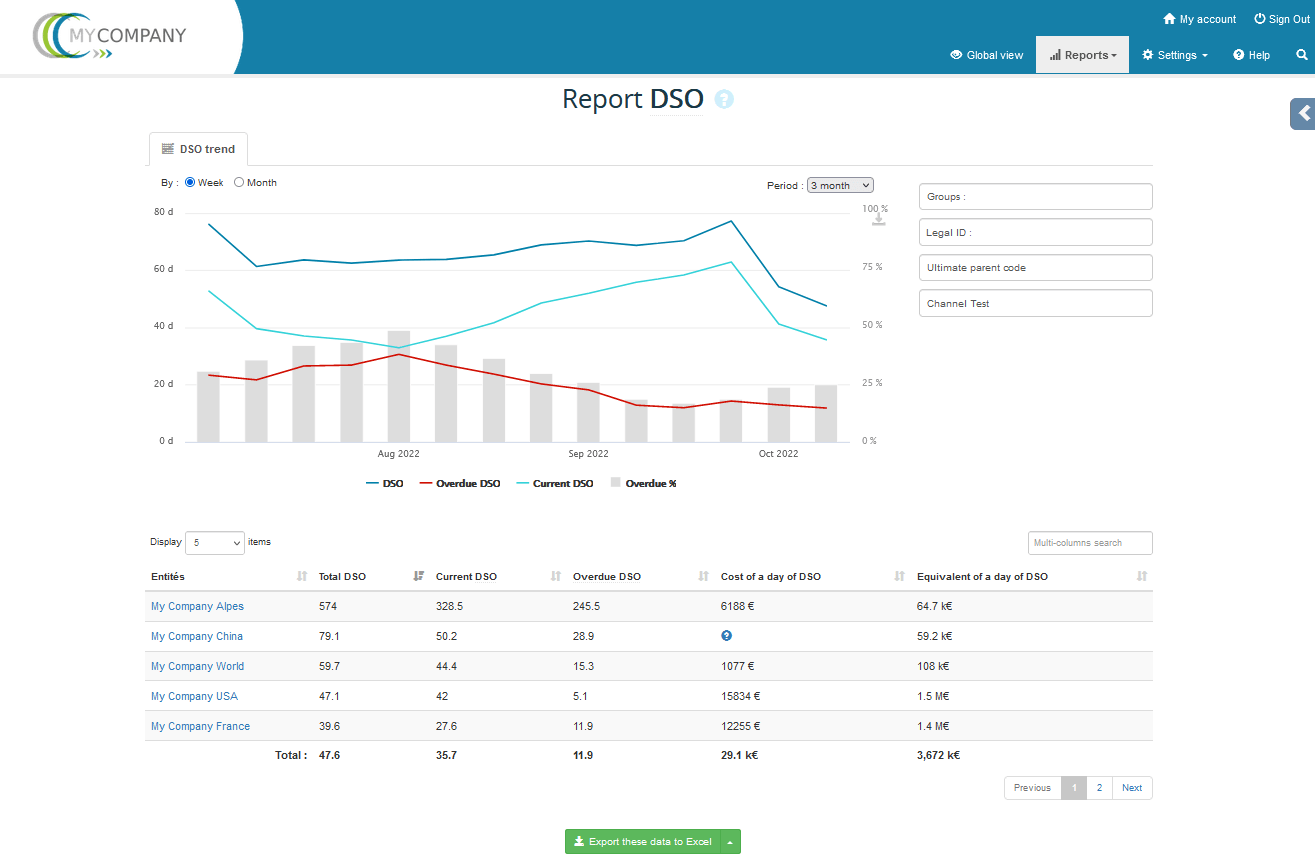

Are you a Group made up of several subsidiaries, multi-ERP, a large international company, mid-sizeed companies or SMEs ? My DSO Manager's multi-entity platform gives you unique access to all of your entities, to consolidated reports in real time, whether on the DSO, the aging balance, the cash forecast, risk, etc.

It allows you to create multi-entity users and grant them access rights to a given perimeter.

They will thus be able to visualize their performance and, great strength of this platform, switch from the consolidated group view to the situation of a simple invoice or a simple customer in a few clicks, even on the scale of an international Group.

Assessing performance through consolidated reports should lead to action to optimize that same performance. This is exactly what My DSO Manager allows with this ultra-smooth navigation between macro and micro.

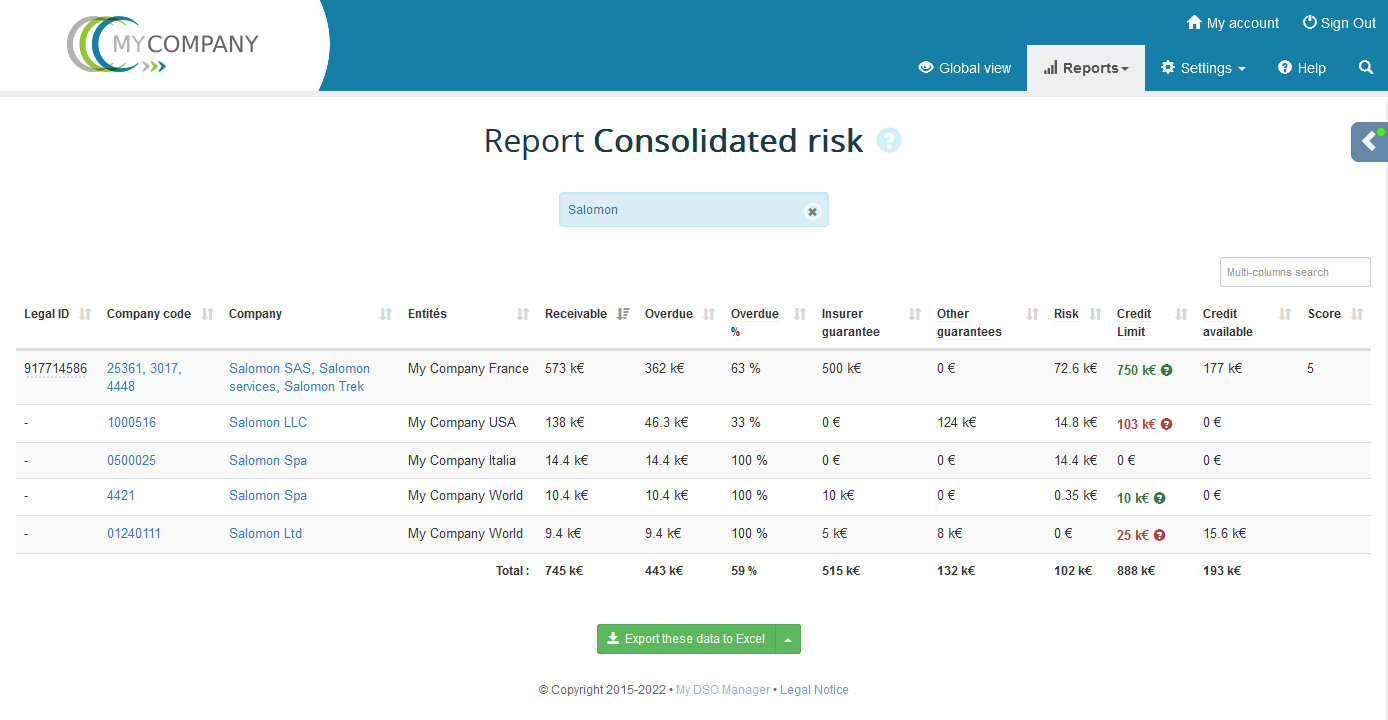

Manage the credit risk of your multi-entity customers

Thanks to an identifier present in your systems, or to a grouping code defined in My DSO Manager, visualize in real time outstandings, delays, credit limits and other insurer guarantees of a multi-entity customer at global level, regardless of the invoicing, guarantee or reporting currencies of the entities concerned.For example below with the Salomon client present in several entities:

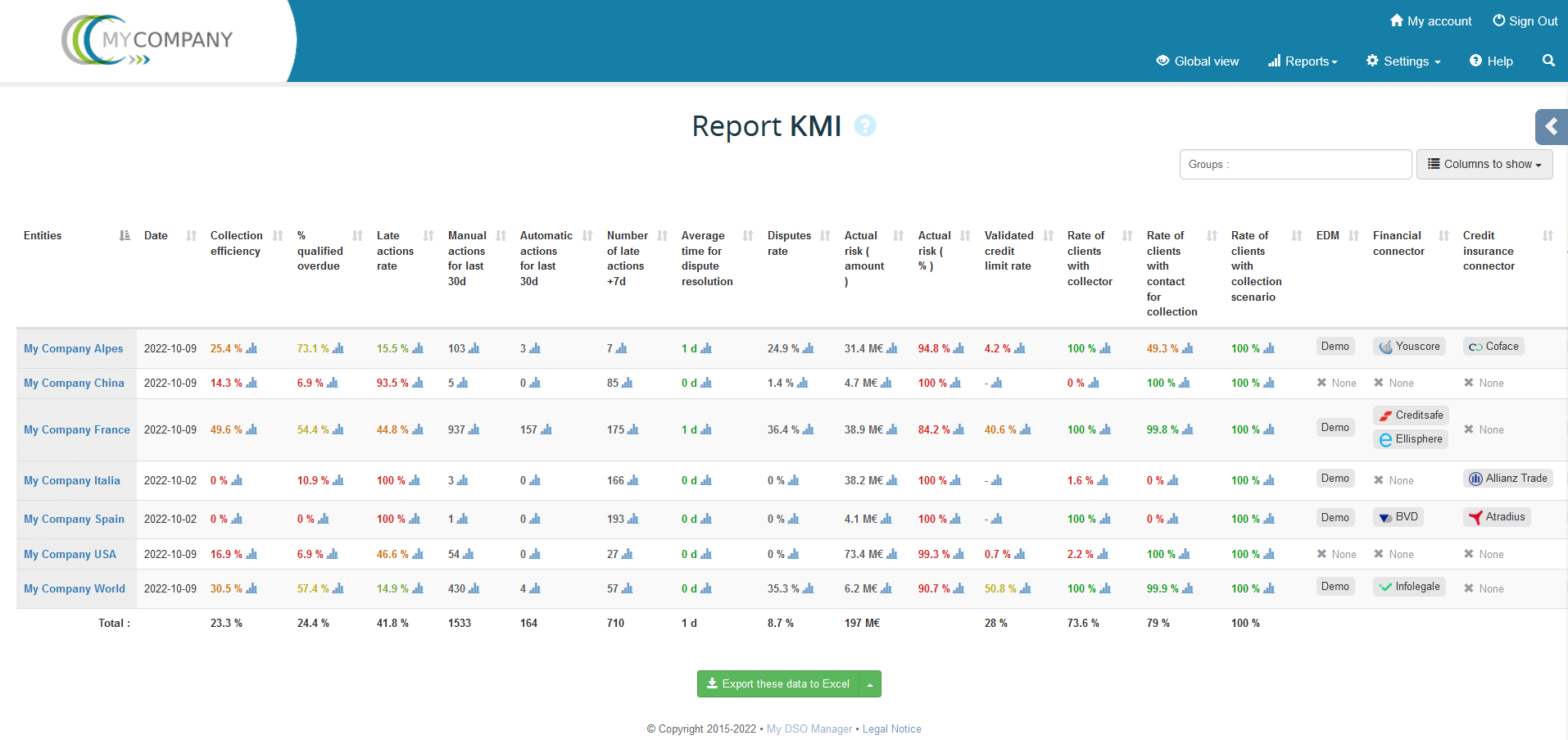

Manage the performance of your entities with the Key Management Indicators (KMI) report

View the performance of each of your entities at a glance. Are the actions carried out on time? What about the invoices qualification rate? Which connectors are enabled on each platform? The KMI report instantly gives you an overview of the quality of receivables management and the resulting performance.