What is the DSO?

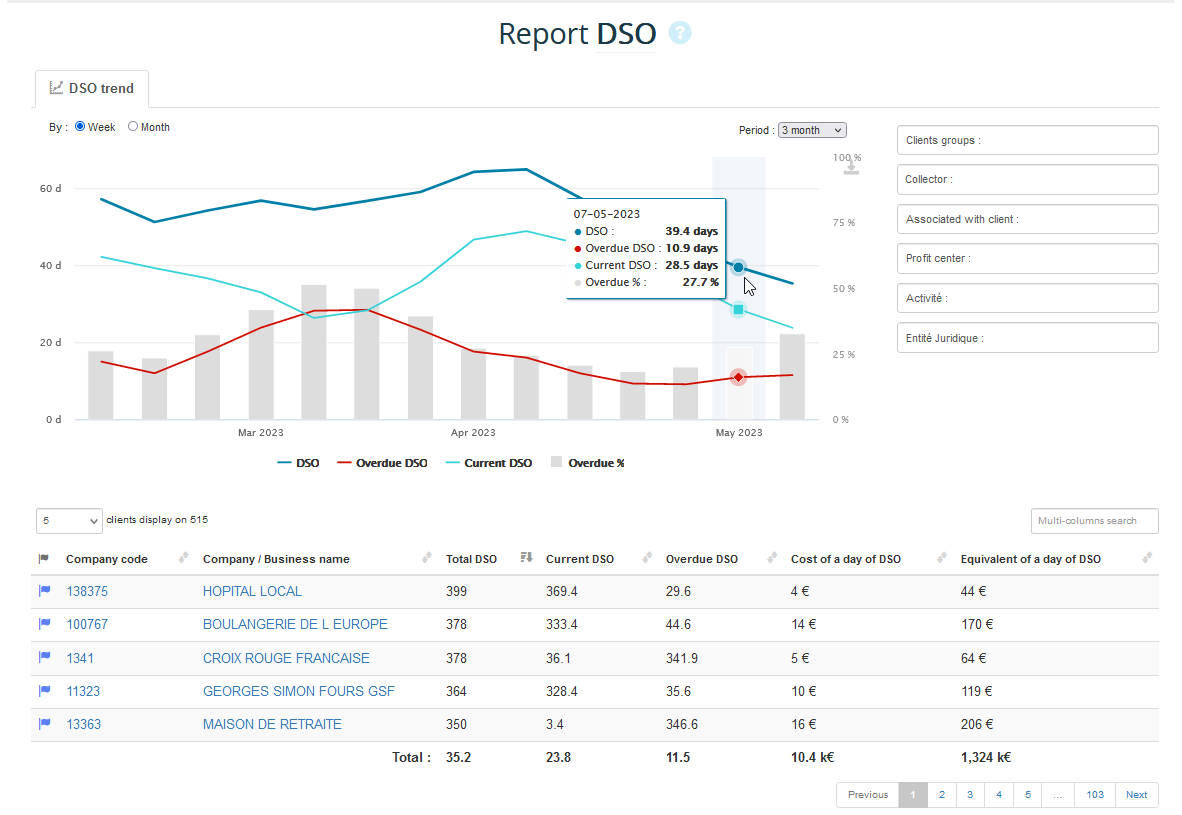

The Days Sales Outsdanting (DSO) is a key performance indicator in Trade Receivable management. It represents the number of days of turnover invoiced and not yet collected, and contributes to the company's working capital requirement.

The lower it is, the better it is for the cash flow and financial balance of any business.

The DSO is induced by the payment terms granted to customers and by their payment behavior. Do they pay on the due date of invoices or late?

There are therefore two main areas for improving DSO: reducing contractual payment terms with customers and carrying out effective debt collection whose aim is to obtain payment on the due date.

How to improve DSO in the era of digitalization of customer relations?

In a constantly changing economic context, companies are faced with new challenges to maintain their competitiveness and optimize their financial performance. One of these major challenges is the improvement of DSO (Days Sales Outstanding), which makes it possible to measure the number of days of uncollected turnover. The digitalization of customer relations today offers new opportunities to meet this challenge.

How to improve the DSO in the era of digitalization of customer relations?

Managing efficiently your company's trade receivables is particularly virtuous for the entire commercial relationship, cash flow and profitability, brand image and customer satisfaction.

Applying the principles of digital credit management holds an unsuspected amount of beneficial gains for your business.

The first of these, which are the most obvious and visible, are:

- The improvement of the Days Sales Outstanding (DSO), Key Performance Indicator in cash collection, illustrating the improvement in cash flow and working capital requirement (WCR).

- The professionalization of the sales process and the improvement of customer satisfaction thanks to the streamlining of communication and the handling of disputes.

- Increased efficiency allowing you to be much more productive while being more qualitative.

The time has come for digital collection!

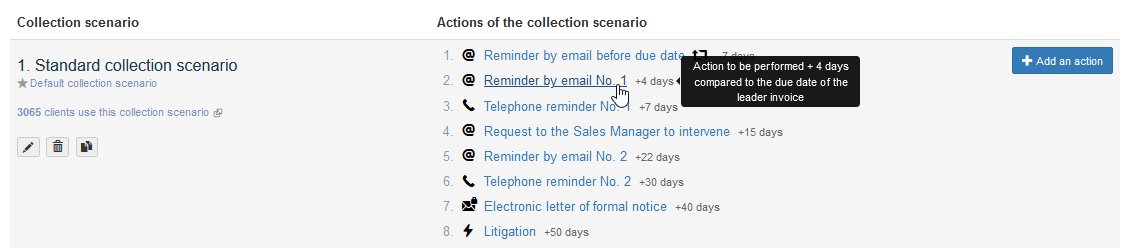

The use of 100% configurable collection scenarios by type of customer, risk category or payment profile intelligently generates dunning actions that include all the information and functionalities necessary for your customers (account statement, overdue amount, interactive portal , PDF of documents, payment button, …) in order to streamline exchanges and accelerate collections.

A doubt on how to proceed? Let My DSO Manager suggests the most effective actions based on multiple dynamic criteria.

If the probability of collection of a debt between professionals decreases very quickly once the due date has passed for few weeks, My DSO Manager allows none to slip through the cracks. It supports to identify the causes of non-payment, to deal with them in a collaborative manner with the customer and colleagues (sales, customer care, …) thanks to relevant and qualitative communication such as interactive e-mails.

The use of our cash collection software makes it possible to keep and find in the same system all the history of data and past exchanges. It eliminates the considerable loss of time of laborious and inefficient work on Excel.

The fluidity of the navigation between the performance indicators at the global level and the detail that composes them provides a very dynamic appreciation of the performance between the macro and the micro. Thus, you understand in an instant the components of the result, and identify customers where you need to act to improve the situation.

With My DSO Manager, you improve your company's cash flow by combining the following principles:

- Collaborative customer risk management (credit limits validation workflow) thanks to decision-making involving all the necessary information located in one place.

- Clever recovery scenarios and actions aimed at communicating with the right people, at the right time and with the right information through a personalized agenda.

- Internal and external collaboration to solve problems and resolve disputes.

- Fluent and qualitative communication thanks to exhaustive and easily accessible information.

- Assessment and performance management on key business indicators: DSO, late rate, recovery rate, qualification of documents, dispute resolution time, cash forecast, etc.

- Integration of all of your partners into the software: credit insurers, financial information providers, payment solutions, Documents Management Systems, etc).

When cash rhymes with customer satisfaction

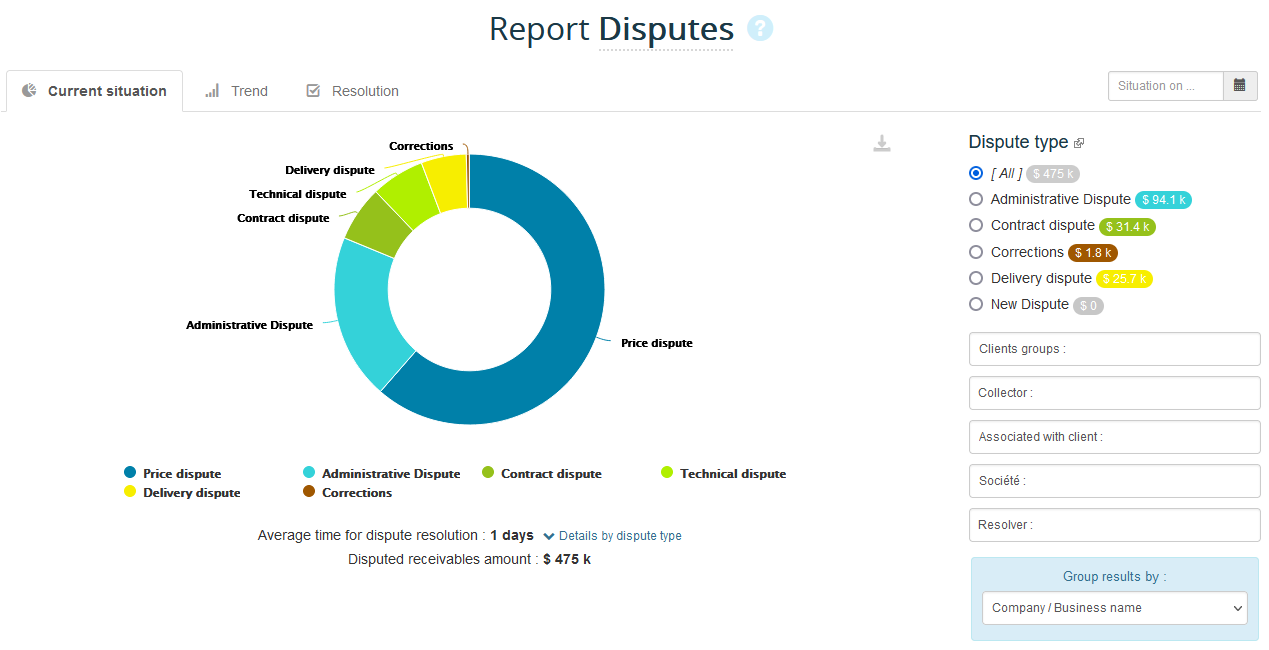

The first cause of late payment between professionals is disputes, i.e. an a priori valid reason given by the customer for not paying: wrong pricing, short delivery, quality problem , administrative issue, etc. Multiple reasons that are all malfunctions of your company's Quote to Cash process.

By identifying and dealing with them quickly, you not only preserve customer satisfaction but also cash flow. My DSO Manager allows you, for example, to send one or more pre-reminders before due date to obtain a promise of payment and identify any dispute. If this is the case, the dispute workflow allows it to be resolved quickly, to respond to the customer and to be paid.

The quality of the Trade receivable and collection management associated with the performance reports (making it possible to identify the customers or the perimeters where the action must be focused on), and the efficient management of the disputes are part of the key elements which, implemented in My DSO Manager, allow to significantly improve DSO and cash flow!